Just released! The first Swiss Climate Scores reports have been launched. The Swiss Climate Scores introduce best practice #transparency for #parisagreement aligned investing.

Introduced in 2022, UBS, working with the Swiss government, has launched the Swiss Climate Scores best practice guidelines to score funds in alignment with the Paris agreement. The scores give investors decision critical transparency and comparability for funds’ climate profiles. Working towards a lower carbon tomorrow.

The goal is to drive Switzerland and its financial markets towards net-zero greenhouse gas emissions by 2050.

“This is needed to honor its obligations under the Paris Agreement of holding the increase in the global temperature to well below 2°C and pursuing efforts to limit it to 1.5°C. Current science indicates that global warming beyond 1.5°C has potentially catastrophic impacts on the natural world and human society.” according to the report.

The Swiss climate scores establish best-practice transparency on the Paris-alignment of financial investments to foster investment decisions that contribute to reaching the climate goals.

All indicators are based on existing and internationally established criteria and methods:

Overall investment objectives regarding climate (new and optional)

Current State indicators:

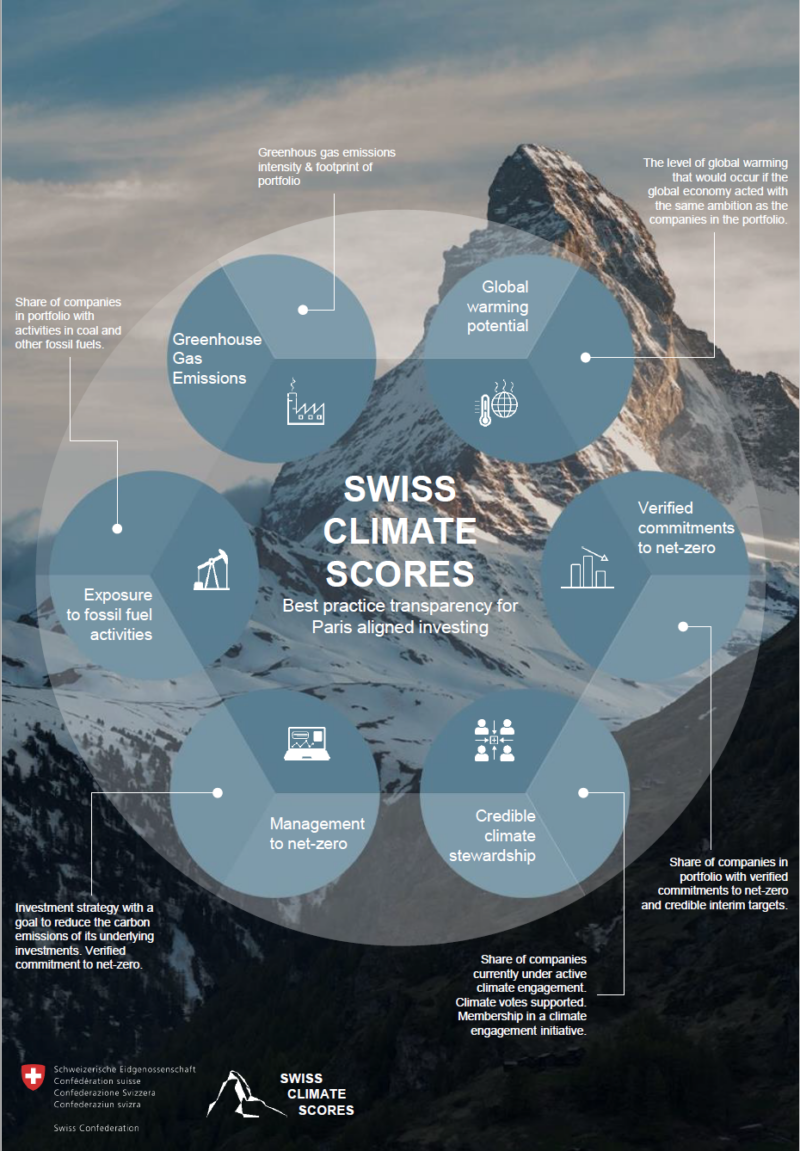

1. Greenhouse gas emissions: Greenhous gas emissions intensity & footprint of portfolio.

2. Exposure to fossil fuels and renewable energy (new sub-indicator): Share of companies in portfolio with activities in coal and other fossil fuels.

Transition to net zero indicators:

3. Global warming potential (optional): The level of global warming that would occur if the global economy acted with the same ambition as the companies in the portfolio.

4. Verified commitments to net-zero: Share of companies in portfolio with verified commitments to net-zero and credible interim targets.

5. Credible climate stewardship: Share of companies currently under active climate engagement. Climate votes supported. Membership in a climate engagement initiative.

6. Management to net-zero: Investment strategy with a goal to reduce the carbon emissions of the underlying investments. Verified commitment to net-zero.

You can find a Presentation on the Swiss Climate Scores here

Visit: State Secretariat for International Financial Matters – SIF